Beyond the Numbers: Limitations of Financial Statement Analysis in Investing

Quality matters more than numbers in investing. I will explain the limitations of financial statement analysis and essential qualitative factors that drive good investment decisions

Hi there, welcome back to AG Quality Capital! As always, we're diving into the world of long-term quality investing in the stock market. In this post:

· Main limitations of financial statements

· Real examples of companies from both perspectives: Good investments with poor financial statements and good financial statements that turned out to be bad investments

Let’s go for it!

The analysis of financial statements is an important part of the process of studying a company; however, they have many limitations, and sometimes it's not possible to see the true value of a company just by analyzing the numbers they report.

THE LIMITATIONS:

1. Omission of Qualitative Information

Undoubtedly, this is the primary limitation of financial statement analysis. Anyone making an investment decision based solely on the numbers reported by a company quarter after quarter will have a terrible experience in the stock market. It is the qualitative attributes that enable companies to report great numbers, not the other way around. Among the main qualitative aspects that can be analyzed in a company are:

Competitive Advantages: A company without competitive advantages cannot be a good investment. When there is a large and untapped market, there will be many competitors interested in the spoils, so if none stand out from the rest, it's better to avoid that investment. Whenever I talk about this, I give the example of the airline sector. If the travel market is large? It certainly is, but how many options do consumers have to choose from? Worse yet, which one do most of them end up choosing? Simply the cheapest one, the one that gets me from point A to point B in the cheapest way. In a sector where competition is based on price, it's impossible to achieve good long-term returns.

The advantages a company can develop are fundamental to its long-term success. Many companies may be able to report very good financial statements, but this is where they attract the attention of competitors. Anyone who sees that a sector is good and profitable will want to enter the competition. So, if the company that achieved great numbers previously does not have a moat to defend itself against competitors, it will not succeed in the long term.

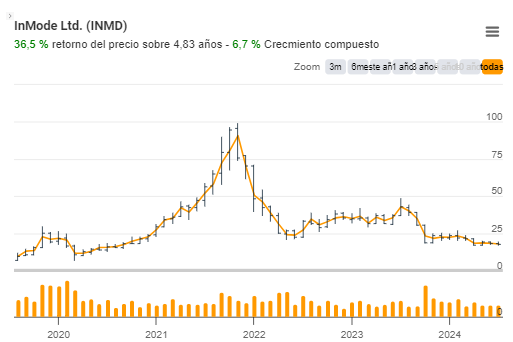

One example of this is a small company called Inmode. Gross margins of 85% and a net margin of 40% would catch the attention of any investor. During the pandemic, they had a good stock performance, but that is now behind them; these returns attracted competitors, and for fiscal year 2024, a 7% decline in sales is expected, while margins are also contracting.

These shares reached a peak of $90, and three years later, they are trading at $17, reporting an 80% decline. Inmode constantly reminds me that I should never invest in a company that bases its competitive advantage on technology; there will always be someone with more resources willing to develop something better. That's why it's better to invest in companies that have something much more sustainable in the long term and the focus I have in barriers to entry.

2. Quality of Management

When you invest in the stock market, you are also investing in people. Those who lead the company have a huge responsibility to their shareholders, as they are responsible for capital allocation and the company's operations. In any analysis work, it's very important to determine how management has performed, how long they have been in their positions, how well they know the industry, how capital has been allocated, how they are compensated (preferably with a significant portion in shares), and what percentage of ownership they have in the company. In short, the list of questions can be endless, and all of them should have answers that provide the investor with the reassurance that they are putting their money in a safe place.

3. Organizational Culture

Organizational culture can even be categorized as a competitive advantage that much of the market overlooks. Products can be very good, management can be impeccable in capital allocation, but if the employees are not happy or if there are no well-defined institutional values, it's impossible to achieve good results.

An example of this is the organizational culture instilled by Jeff Bezos at Amazon, which has been unmatched. The passion for invention, the long-term horizon and strong reinvestment in the business have always been present at Amazon. Without this, something like AWS, Kindle, Amazon Go, Prime, Alexa would not exist. Despite being a company valued at almost $2 trillion, its future remains quite promising thanks to its culture.

The best part is that Amazon has been one of the most successful investments in history with financial statements that have always seemed quite mediocre. Operational margins that have historically averaged 5% are not what many people expect from Amazon; however, they have managed to leverage their cash generation to continue investing heavily in their growth.

4. External Factors

The behavior of companies in the stock market is influenced by external factors that cannot be determined by financial statements. Companies operate in a competitive environment. How can an investor know through a quarterly report about the advancements being made in the development of a product or service by a competitor? They are also exposed to economic conditions that affect consumer behavior (inflation, interest rates, unemployment). Some also face geopolitical risks that can pose a significant threat. All these factors must be analyzed carefully, and the best decisions should be made based on the external risks they face.

5. Consumer Behavior

I firmly believe that good analysis work must be accompanied by an analysis of consumer behavior toward a company's products or services. Some companies simply become essential to consumers. Tell an iPhone user to switch phone providers, or a company using Salesforce to look for another CRM. What would happen to consumer behavior if Visa or Mastercard suddenly ceased to exist? Some products are so ingrained in our society that it's hard to imagine how the world would function without them. Can this be somewhat reflected in financial statements? Not in all cases, check Salesforce's numbers—you would be surprised by the low operational margins and reported earnings.

6. Business Strategy

In financial statement analysis, it is not possible to know the business strategy. If a company bases its growth model on acquisitions, it is difficult to report high returns on capital, even if it is disciplined in its pricing and the quality of the companies it acquires. An example of this is what has happened in the last decade with companies like Roper Technologies or Brown & Brown. Their returns on capital do not exceed 10%, which at first glance may seem quite mediocre, but their capital allocation has been so excellent and disciplined that the stock performance has been much higher than that.

The case would be different for a company that reported capital returns of the same 10% but whose strategy is based on launching new products to market. The capital allocated to this type of investment is much lower compared to an acquisition, so it is logical to expect higher returns. Thus, while the results may be similar for two companies, the strategy they use to achieve their returns will mark the difference in their stock market behavior.

Final words:

In a market where qualitative analysis should be the focus for achieving significant returns, it is crucial for us as investors to look beyond the numbers. Understanding the qualitative aspects and external influences can make a substantial difference in our investment outcome.

What mistakes have you made in evaluating companies based solely on their financial statements? By sharing our learning from investment errors, we can all benefit and become better investors.